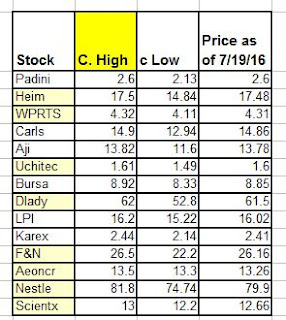

One of the company that I put in my winning list is Scientex. Many people don't really understand why I create this winning list. See, the thing is simple, in the investment world, the stock price always move with momentum, or what we call it, trend. Hence, understand the trend is very important before invest the money into it. In this case, we want a company that keep on growing in profit. This is important, because if the company can sustain this momentum in last two year, last year and this year, the tendency to make profit is higher. If most of the investor have a strong believe and they think that this company have a good reason to invest, all will rush in to buy it. Scientex yesterday announced the quarterly report, the profit increase 10.7% compared to previous quarter. The earning per share is 23.54 cents, this making the whole year's earning per share 105.88 cents or increase of 52.3% compare to previous year. As I always like to make the investment in simple