Gold price and Interest Rate

Prediction by HDBS, economy already recovered and short term interest rate is expected to increase in next 6 months.The recovery of economy going to take time, hence, expected long term interest rate to remain stable.

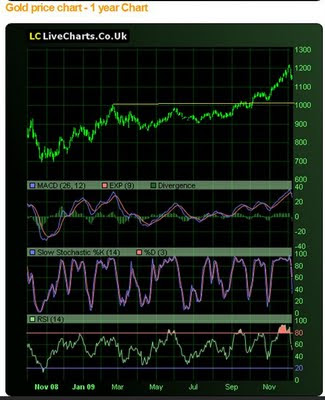

What would be the impact to Gold price? In view of the short term interest rate going to increase, the cost of holding gold would increase. People going to liquidate their position and they will when gold price start to show weekness. From the chat, gold price has breakout the long term resistence of USD1000 recently and touch the high of USD1200+. However, the gold miner chat not show the similar pattern. Who is the buyer that cause gold price go up all the way after breaking USD1000 level? Well, the research report show for top 10 holder of gold, all are countries but except the top buyer, which is a company. Since they bet on the gold price will going up, sooner or later, when the price going soft, they will force to liquidate their position.

Another similar commodity, oil, which expected to stay at the range of 70 to 80 dollars. Oil price will remain flag for time being, after hitting the peak of USD130+, now remain stable at around USD70. In 2009, Oil unable to break out USD80, this show that the demand is not as high as market anticipated. Further, Rusia and China make a deal on building up oil pipe to suply oil for China at an undisclosed price also indicate that supply is able to meet demand for China due to Rusia has no other choice to pay back the loan, except exchange with oil.

Let review the similar post by end of the year if the prediction is correct or not, as personally I am not quite agreed with the prediction of Interest Rate is going to give any impact to gold price.

Comments

Post a Comment