Single Tier Dividend - Good or bad for retail investor?

Two years ago, Malaysia government introduce the system of Single Tier Dividend. There will be a transition period of 6 years until 31 Dec 2013 for the existing company to comply with this system. Many are so excited, because they say, oh... nice... now dividend receive no need to pay tax and no need to declare as well. Few weeks back, when I discussed with my team here and I noticed that many still unaware that we, as individual investor will lose a bit, especially for retiree. Why?

Let look first why government want to introduce this system? Many reasons given, the main one, save administration cost to refund tax to individual and individual no need to pay tax as the tax under company is a final tax. By doing that, Government can boost their tax income and save a lot of follow up work!

Imputation System

The current system for dividend pay out is call Imputation System. For example, when a company make a profit of $100, government will take $25 (25% of tax) so the profit after tax is $75. Let say, now the company want to pay out all the profit as dividend (usually the company seldom payout 100%), so the tax paid by company are passed to share holder as tax Credit. (S110) In this case, the company will have Imputation Credit of $25.

Share holder receive $75 as net, but need to declare RM100 as gross income with 25% tax deducted. In this case, many still assume they will receive gross dividend as $75, but actually the gross is RM100 and you can claim back 25% if your tax bracket below 25%...

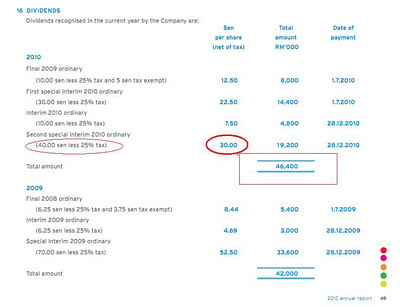

Let study the actual case under Dutch Lady (Dlady) annual report :

In Dlady's case, the 2nd special interim gross dividend is 40 sen, but 30 sen was recorded in company's statement. So the total paid out is: 64,000k (total shares) x 30 sen = $19,200k.

For the year of 2010, total payout was $46,400k and was recorded in P&L Statement:

In above case, if investor bought the share just before Dlady declare the 2nd special interim dividend, he will receive net 30 sen, the dividend voucher will record as gross 40 sen, tax deducted 10 sen(25%). If the share holder fall under tax bracket of 19%, he is entitled to a refund of 6%.

Single Tier System

Under this system, tax paid by company (25%) is final tax. When a company make a profit of $100, government will take $25 (25% of tax) so the profit after tax is $75. Let say, now the company pay out all the profit as dividend, there will be no more Imputation Credit.

Share holder receive $75 as net, no need to declare as income.

Assume after 2013, Dlady still pay the same amount of 2nd special interim dividend, under the company's statement, it will mention as 30 sen under Single Tier Dividend. (same under company's statement)

Share holder will receive net 30 sen, it's tax exemption and not require to declare.

So, now you know the reason why no need to declare dividend under Single Tier System?

Share holder is unable ask for refund of 6% in the above case. (low income tax payer is main loser in this case)

.

Let look first why government want to introduce this system? Many reasons given, the main one, save administration cost to refund tax to individual and individual no need to pay tax as the tax under company is a final tax. By doing that, Government can boost their tax income and save a lot of follow up work!

Imputation System

The current system for dividend pay out is call Imputation System. For example, when a company make a profit of $100, government will take $25 (25% of tax) so the profit after tax is $75. Let say, now the company want to pay out all the profit as dividend (usually the company seldom payout 100%), so the tax paid by company are passed to share holder as tax Credit. (S110) In this case, the company will have Imputation Credit of $25.

Share holder receive $75 as net, but need to declare RM100 as gross income with 25% tax deducted. In this case, many still assume they will receive gross dividend as $75, but actually the gross is RM100 and you can claim back 25% if your tax bracket below 25%...

Let study the actual case under Dutch Lady (Dlady) annual report :

In Dlady's case, the 2nd special interim gross dividend is 40 sen, but 30 sen was recorded in company's statement. So the total paid out is: 64,000k (total shares) x 30 sen = $19,200k.

For the year of 2010, total payout was $46,400k and was recorded in P&L Statement:

In above case, if investor bought the share just before Dlady declare the 2nd special interim dividend, he will receive net 30 sen, the dividend voucher will record as gross 40 sen, tax deducted 10 sen(25%). If the share holder fall under tax bracket of 19%, he is entitled to a refund of 6%.

Single Tier System

Under this system, tax paid by company (25%) is final tax. When a company make a profit of $100, government will take $25 (25% of tax) so the profit after tax is $75. Let say, now the company pay out all the profit as dividend, there will be no more Imputation Credit.

Share holder receive $75 as net, no need to declare as income.

Assume after 2013, Dlady still pay the same amount of 2nd special interim dividend, under the company's statement, it will mention as 30 sen under Single Tier Dividend. (same under company's statement)

Share holder will receive net 30 sen, it's tax exemption and not require to declare.

So, now you know the reason why no need to declare dividend under Single Tier System?

Share holder is unable ask for refund of 6% in the above case. (low income tax payer is main loser in this case)

.

Thanks for the article! It helped clear a lot of doubt for someone like me who doesn't understand accountancy parlance.

ReplyDeleteGd writeup, Thx!

ReplyDeleteFor the 2nd paragraph of imputation system,

ReplyDeleteit should be "declared $100 and gross $100" but not RM100

rite